At a glance:

- House prices rose by 0.2% in April, taking the annual average rise in prices across the UK to 4.9%

- Prime central London prices remained unchanged in April, with an annual growth rate of 0.5%

- Average UK rents up 2.6% on the year in March, and 3.7% in London

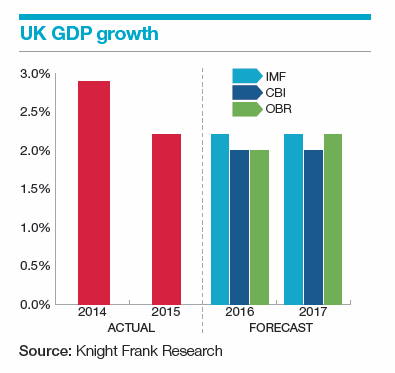

The EU Referendum is starting to dominate most discussions about the UK economy, but it is worth listening to the mood music emanating from the economy. A slowdown in activity has led several key economic and business bodies to revise down their forecasts for GDP.

The CBI has said that the UK economy will grow by 2% this year and next, down from its previous forecast for 2.3% growth in 2016 and 2.1% in 2017, while the IMF now expects 2.2% growth in both years.

In the housing market, monitoring the “wait and see” effect of the EU Referendum, with some buyers and sellers choosing to hold off making a move until the outcome is clear, is more challenging given other policy changes.

The key change has been the introduction of the extra 3% stamp duty payable for the purchase of additional homes. The rule came into force on April 1, and as a result there was a rush of activity in March as buyers sought to complete their purchase and thereby avoid paying the extra tax. This took transaction levels to a record high. As can be seen from the chart below, such sharp increases usually unwind in the following months, and this is what we expect to see in May and June.