Households across the UK perceive that the value of their home fell in July, according to the latest House Price Sentiment Index (HPSI) from Knight Frank and IHS Markit.

This is the first time the HPSI has fallen below 50, the index reading that points to no change in prices, since February 2013. July’s reading is the first indication of household sentiment on property prices since the EU referendum with households across all price bands and tenures surveyed between the 14th and 18th of July.

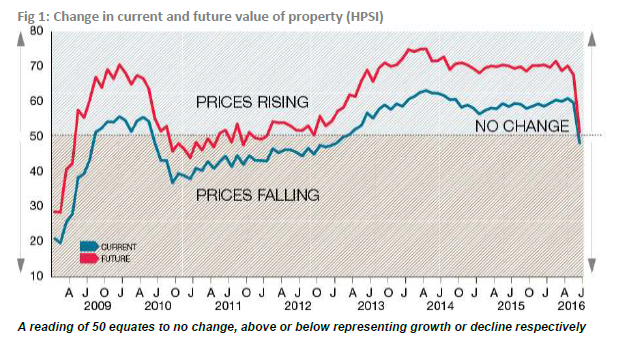

Some 11.2% of the 1,500 households surveyed across the UK said that the value of their home had risen over the last month, while 14.6% said that prices had fallen. This resulted in a HPSI reading of 48.3 (see figure 1).

July’s reading was a decrease from the 59.7 recorded last month and significantly below the peak of 63.2 recorded in May 2014. The sharp drop month-on-month was amplified by the resilience of the index ahead of the EU vote. Indeed, the average HPSI reading in the three months prior to July was 60.3.

Households in all regions, barring the South East (50.2) and the East of England (50.2) perceived that the value of their home dipped in July, with the biggest loss of momentum coming in London (49.5 from 69.6 in June). This was the first time that households in the capital perceived that house prices had fallen since October 2012.

Outlook for house prices

The future HPSI (figure 1), which measures what households think will happen to the value of their property over the next year, fell to 50.3 in July

from 67.7 in June. This is the lowest reading recorded by the index since October 2012, indicating that households expect more modest rises in the value of their home than any time in the intervening years.

However, while the sentiment index has fallen, the expectation is still for positive, albeit modest, growth over the next 12 months.

There remain regional variations in future house price sentiment, mirroring trends in the wider housing market. Londoners are the most confident that prices will rise over the next year (56.3) followed by those in the South East (54.5) and East of England (53.2).

Gráinne Gilmore, head of UK residential research at Knight Frank, said: “The impact of uncertainty in the wake of the Brexit vote is clear from the HPSI index reading for July, especially in light of the relative strength of sentiment in the run-up to the vote. Although there has been a marked drop in the index, the readings are hovering around the ‘no-change’ mark, similar to levels in 2012/2013. As well as geographical variations, there are wide differences in expectations depending on age-groups, with those aged over-55 expecting the value of their home to dip over the next 12 months as well as those aged 18 to 24. All other age-groups expect prices to rise modestly.”

Tim Moore, senior economist at IHS Markit, said: “The surge in economic uncertainty after the EU referendum weighed heavily on UK house price sentiment during July. The current prices index signalled the greatest month to month loss of momentum for at least seven-and-a-half years. Despite a sizeable fall since June, the latest reading signalled that house price sentiment was at a level last seen in early 2013 and only marginally downbeat overall.

“Households across all UK regions also indicated a sharp recalibration of their property price expectations for the next 12 months, led by those living in London and the South East. Before the EU referendum, more than five times as many UK households (43%) expected a year-ahead rise in property values as those that forecast a reduction (8%). By contrast, there is now a fairly even split between individuals expecting a rise in property values (26%) and those anticipating a decline over the next 12 months (23%).

“While it is too early to evaluate the full impact of the EU referendum on the UK property market, it is already clear that heightened uncertainty has cast a shadow over household sentiment. At the same time, fundamental imbalances between housing supply and demand have not changed materially, while lending conditions remain supportive. Nonetheless, a sharp jolt to consumer confidence in July has impacted swiftly on UK households’ perception of their property value, and this is also a signal that price expectations could remain highly sensitive to economic and political developments over the months ahead.”