Households across the UK perceive that the value of their home has risen over the last month, according to the latest House Price Sentiment Index (HPSI) from Knight Frank and IHS Markit.

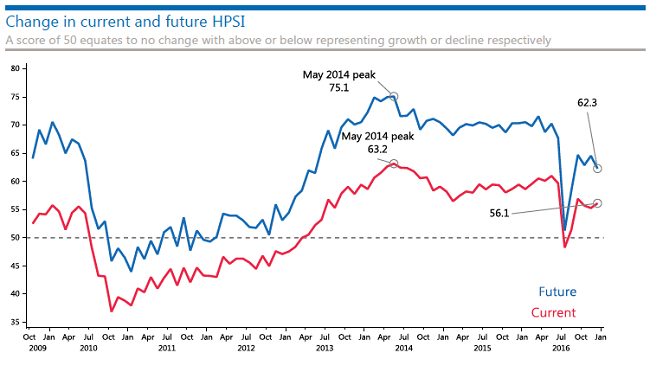

December’s reading marked the fifth consecutive month that the index has been in positive territory following the post-referendum low in July with a reading of 56.1.

While December’s reading was a slight increase from the 55.3 recorded in November, it remains significantly below its peak of 63.2 recorded in May 2014. It is also lower than the reading of 59.4 recorded in December 2015, reflecting the easing in house price growth seen since then.

However, households in all 11 of the regions covered by the index perceived that the value of their property rose in December, only the second time that this has happened since the EU Referendum in June.

Outlook for house prices

The future HPSI, which measures what households think will happen to the value of their property over the next year, dropped slightly in December to 62.3, down from 64.6 in November.

Knight Frank forecasts for the UK property market, released last month, also point to an easing of price growth in 2017. There remain quite large regional variations in terms of household expectations, with Londoners (69.0) the most confident that prices will continue to rise. Households in Scotland are expecting the smallest gains (54.1).

However, house price expectations eased in December compared with the previous month in nine of the eleven regions covered by the index.

Gráinne Gilmore, head of UK residential research at Knight Frank, said: “Households expect the value of their home to rise over the next 12 months, but at different rates across the regions, reflecting the ‘multi-speed’ nature of the market in geographical terms.

“However, the pattern of expectations across age groups has changed since the vote to leave the EU, indicating that the level of uncertainty is causing a coalescence of opinion on future price growth. Overall the reading is for price growth, the typical trend over the last few years has been for the index to show that those aged over 55 expect larger increases in the value of their home than those aged between 25 and 34 – reflecting the higher levels of homeownership among older people. This gap was reversed for three months after the vote.

“While those aged over 55 are now once again predicting stronger price growth than those aged 25 to 34, the gap between the two groups in November and December has shrunk to the smallest margin since late 2014, marking a more even spread of expectations around house price regardless of age or tenure.”

Housing market activity

Some 5.2% of households plan to purchase a new property within the next 12 months, down from 6% in October.

But while the number of households planning to purchase in the short-term has fallen, there was an increase in the number taking a medium-term view on purchases, with 13% planning to buy within 2-5 years’ time, up from 11.5% in October.

Tim Moore, senior economist at IHS Markit, said: “UK house price sentiment rebounded swiftly from its low point after the EU referendum, but confidence has now settled in at its lowest range for three-and-a-half years. This pattern has been seen across all UK regions, likely reflecting heightened economic uncertainty and a more subdued near-term outlook for household finances.

“At the same time, headwinds to house price momentum have been counterbalanced by ultra-low mortgage rates, entrenched supply constraints and resilient consumer confidence.

“Looking ahead, UK households expect an increase in their property value over the course of 2017, with those living in London and the South East the most likely to anticipate a rise. However, year-ahead forecasts moderated in December, and the proportion of UK households expecting no-change in house prices reached its highest since January 2013 (54%).”