Households across the UK perceive that the value of their home rose in September, according to the latest House Price Sentiment Index (HPSI) from Knight Frank and IHS Markit.

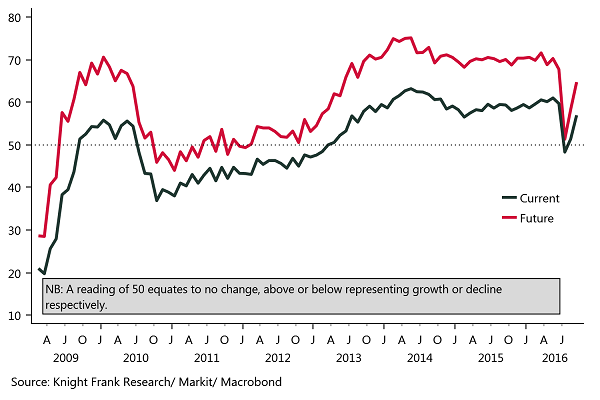

This was the second consecutive monthly rise in house price sentiment following the result of the EU Referendum in June. September’s reading of 56.9 was an increase from the 51.4 recorded in August, and was the largest month-on-month increase in the index in seven years.

However, in spite of the jump, the index remains below the average HPSI reading for the first six months of the year, prior to the EU Referendum, (59.9) and significantly lower than the peak of 63.2 recorded in May 2014.

The future HPSI, which measures what households think will happen to the value of their property over the next year, also rose in September to 64.7 from 58.3 in August.

However, similarly to the headline index, while future sentiment has risen notably month-on-month and is comfortably above its recent post EU Referendum low of 51.3 in July, it remains lower than seen during the three years prior to the vote.

Gráinne Gilmore, head of UK residential research at Knight Frank, said: “House price sentiment is mirroring the broader pick-up in confidence after Brexit. This comes as initial data shows a continuing positive picture for both employment and economic output.

“The housing market is now entering the typically busier autumn season, with indications that activity is rising, especially in key urban areas.

“There is still uncertainty surrounding the next steps of how the UK will move to exit the European Union, and this could create some economic turbulence. Yet the fundamentals of the housing market remain unchanged, underpinned by limited supply and ultra-low mortgage rates.”

Housing market activity

Some 5.8% of households are planning to buy a property in the next year, a slight fall on the 6.5% who said the same thing in June. Londoners are the most likely to move in the short term, with 8.9% of households looking to purchase a property in the coming 12 months.

Tim Moore, senior economist at IHS Markit, said: “September data highlights a sustained recovery in house price sentiment from the three-and-a-half year low seen just after the EU referendum. In each of the past two months, UK households’ views have become more upbeat in terms of both current property values and expected prices for the year ahead. There are early signs of a V-shaped recovery in house price sentiment across all UK regions monitored by the survey.

“However, looking through the summer volatility, house price sentiment remains weaker than seen on average in the first half of the year, and well below the peaks seen during spring of 2014.

“As a result, recent survey data indicates that Brexit uncertainty has temporarily dented but not derailed housing market confidence. Moreover, the prospect of low interest rates for longer and an entrenched shortage of housing supply are key factors supporting UK property values.”