Real estate continues to attract private investors and so understanding their drivers and requirements is increasingly important for all investor types.

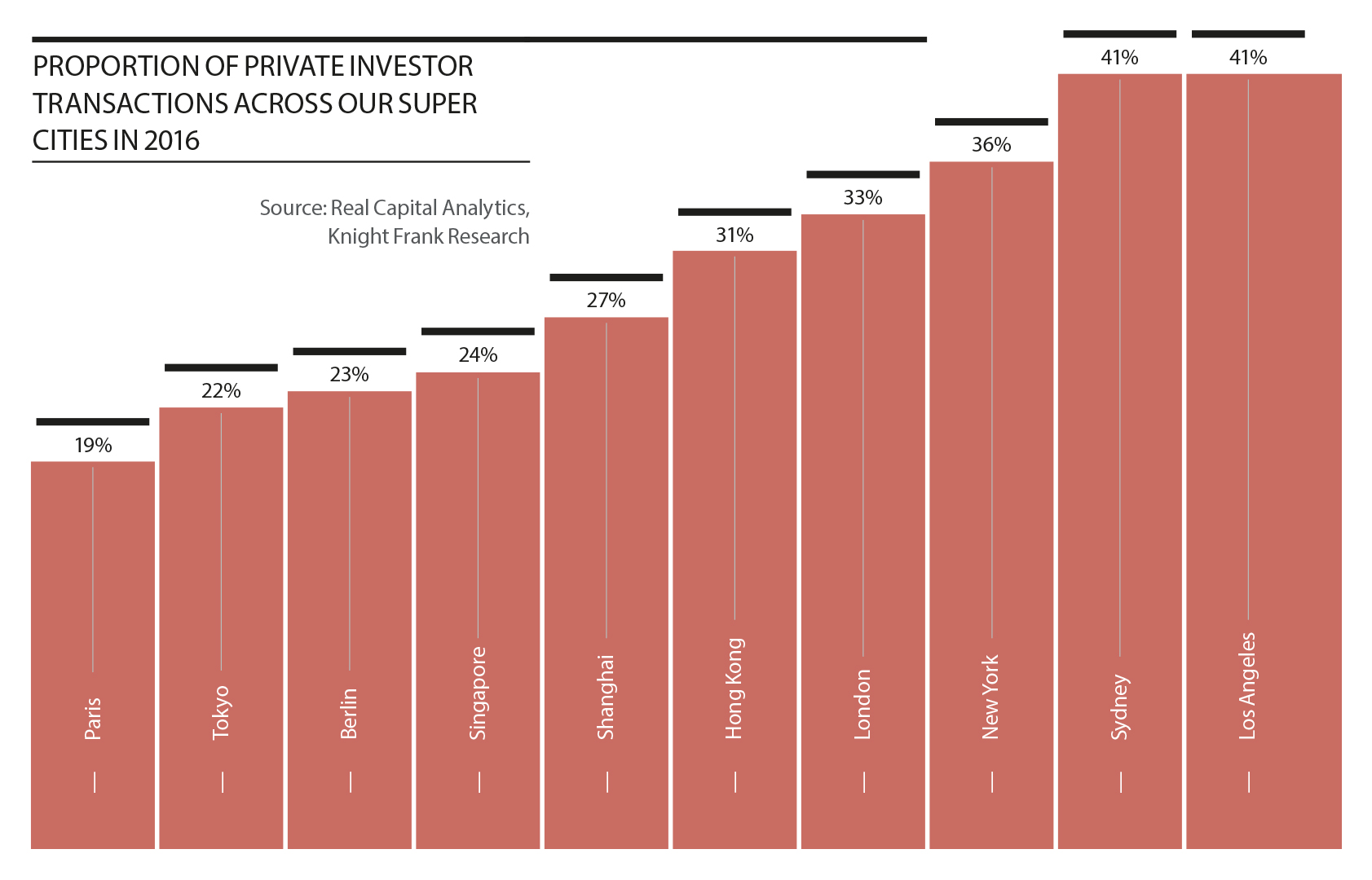

Private investors are an increasingly important cog in the global real estate marketplace. As our latest Wealth Report notes, 27% of all global commercial property transactions in 2016 involved a private buyer. And a quarter of private wealth is held in real estate investments of some kind (excluding primary residences and second homes).

As private investors grow in importance, institutional investors are realising that they are a key buyer type whose drivers are often very different to their own and need to be understood; as they are likely to either be competing against them in a purchase negotiation or trying to sell to them as part of an exit.

Growth in private wealth

Our prediction is that private investors will continue to take global market share as both the number of wealthy individuals and their assets grow.

- The number of Ultra-High- Net-Worth Individuals (UHNWIs) – those with $30 million or more in net assets – rose by 6,340 in 2016 alone, taking the total to 193,490.

- Looking forward, the world’s population of UHNWIs is set to rise by 43% by 2026 to over 275,000 people.

- As you would expect, within this number there are considerable variations in the growth rates in different regions and countries with local factors driving wealth creation and the mobility of UNHWIs.

- Asia is starting to challenge the US in terms of the largest regional population of UHNWIs. At present, Asia is home to 27,020 fewer ultrawealthy people than the US, but by 2026 this difference will have shrunk to just 7,068.

- However, while North America may not top the growth rate charts it will stay the largest hub of UNHWIs in 2026 and growth will continue to outstrip many other developed economies.

- While China will continue to lead the way in Asia, places like Vietnam, Sri Lanka and India will also see substantial expansion.

“The number of global billionaires now totals 2,024 – an increase of 45% in the past decade”

Allocations to real estate

We fully expect that the appetite from private investors for commercial property will continue to increase. Indeed, our Wealth Report research shows that 32% of UHNWIs will invest in cross-border real estate deals in the next two years. While the drivers behind these purchases will vary greatly depending on the motivations of the individual, there are a number of investment themes we are seeing in the market:

Risk mitigation: Risk, especially political and economic, will continue to be high on investors’ agendas in 2017. Individuals are looking to diversify at both a portfolio and geographical level. Real estate provides the ability to achieve targeted investment decisions in terms of location, sector and tenant components as well as provide regular income and an underlying asset with residual value.

Control: One of the consequences of the global financial crisis was that many investors looked for more control over their assets. Real estate, with its direct ownership structure, diversity of lot sizes and choice of asset management approaches is attractive to those not wanting to pass decision making to third-parties or to be constrained by the closed-end fund model of transacting at specific times plus the need to reach an alignment of views between the investors.

Currency diversification: While foreign exchange returns are not generally a driver for property investment, currency movements and capital controls have, in some instances, been a trigger for investors looking to externalise capital from locations implicated.

Portfolio globalisation: Many UHNWIs have, either directly or indirectly allocated part of their asset portfolio to real estate and, as they accrue more wealth, they increasingly become fully exposed to their domestic market and look to new markets to diversify their portfolios.

Strong demand

These themes, plus individual investor specific drivers, will continue to attract private investors towards global real estate. The top markets targeted will primarily be those exhibiting solid fundamentals including tenant demand, liquidity and transparency; with the Super Cities top of the list. However, increasingly we are advising clients not only on prime office, retail and hotel assets in these cites but also strategic investments in growth sectors such as urban logistics, leisure and specialist operating assets including student housing and multihousing.

Overall, property as an asset class will remain high on the agenda of private investors in 2017.