As the economic and investment environment shifts, new opportunities and challenges will be created. How should investors navigate through this period?

Transaction volumes to remain robust

It appears likely that global transaction volumes have peaked, at least for the next couple of years. However, while we might not reach the levels seen in 2015, we expect activity to remain at or above the long term average; driven by investor dry powder at record highs and undiminished appetite for real estate across a deep pool of buyer types.

Given this picture of strong demand, the key determinant of transaction volumes will be the availability of suitable assets on the market. As returns have moderated across many markets following the strong appreciation in values over the last few years, many owners of real estate have moved away from a trading mind-set and towards a long-term hold strategy. Increasing frictional costs of completing a transaction, such as rising taxes and tighter ownership restrictions across a number of markets, has exacerbated this trend. This movement in strategy can quickly slow a market as investors are further persuaded against selling by the increasing difficulty in redeploying the capital.

“We expect activity to remain at or above the long term average; driven by investor dry powder at record highs and undiminished appetite for real estate across a deep pool of buyer types”

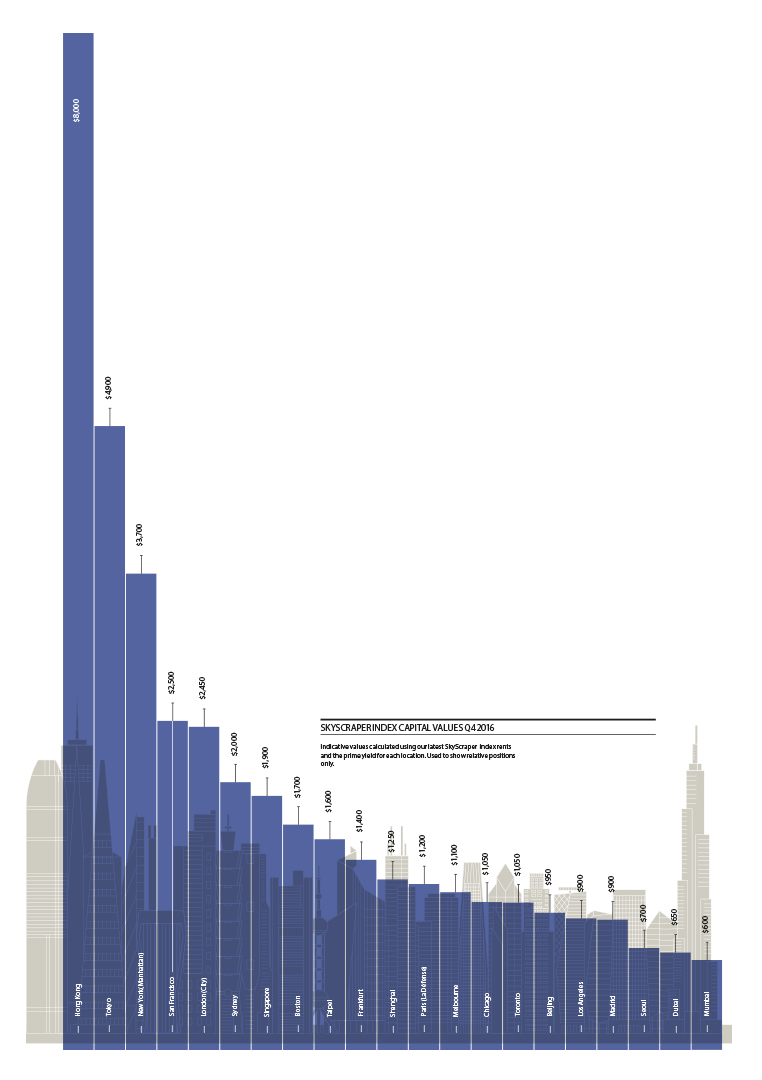

Optimistic pricing

However, further compression of yields, particularly for prime assets with reversionary potential, will shake out more stock over the next 18 months. In particular, opportunistic funds and developers will be tempted to exit as the price inflation caused by this shortage of opportunities means that many will realise their business plans ahead of time.

The varying pace of economic growth since the global financial crisis has led to a multi-stage tenant market and improving fundamentals in those markets that have been slower to recover are now recording stronger occupier dynamics that will drive positive rental value growth and capital value outperformance.

Other markets are later in the cycle but will continue to be supported by strategic global trends that will drive occupier requirements and, therefore, support rental growth and values. Office market demand will continue to be buoyed by the rise of co-working operators, industrial has much further to run as the e-commerce revolution evolves and various specialist sectors such as student housing and multihousing are at still at an early stage of maturity in many geographies.

Cautious long-term income

While we remain positive on pricing for many asset types and geographies, we are also hitting a point in the global cycle where fewer key locations look attractively priced for long-term income. With the increasing globalisation of investor requirements comes a wide pool of buyers with similar requirements for bond-type income and these narrow-focused mandates have squeezed pricing hard. However, any unsated demand will be funnelled towards markets outside of core locations that will now appear to be offering the most value; here pricing should move rapidly.

Locations to watch

As the economic environment for real estate investment starts to shift, emerging market locations will start to attract the attention of global investors. However, this will not be at the expense of our Super Cites and other gateway locations. New global or regional entrants, investors still looking to achieve target allocations and those looking for a secure home for their money will continue to focus on core locations and the depth of capital chasing these markets will support pricing.

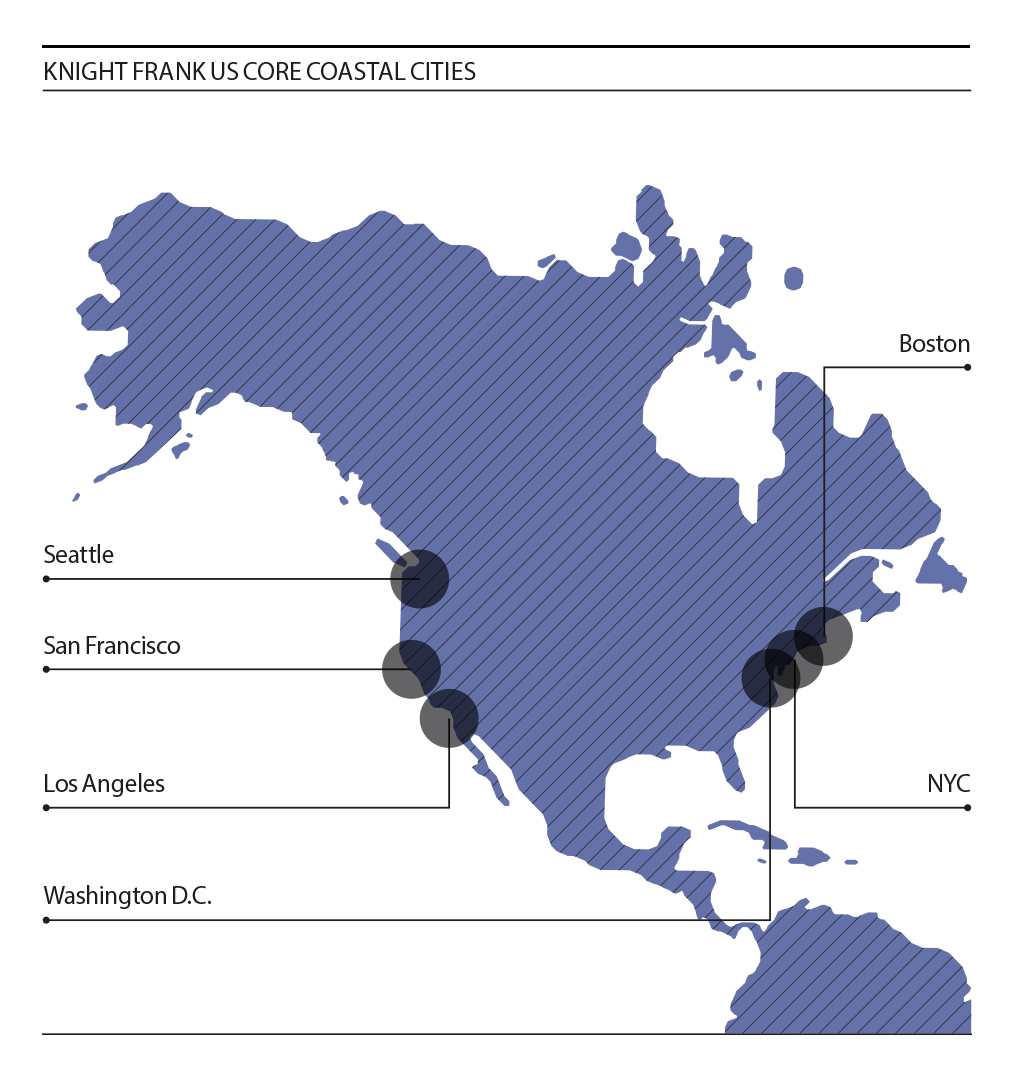

A deep pool of buyers for US real estate

Investors will continue to target the US but we note an increasingly cautious attitude as issues such as policy uncertainty, rising borrowing costs and increasing construction activity in both the mainstream commercial and multihousing markets rise up the watchlist. We expect that transaction volumes will be lower than the last few years but should remain steady with a deep pool of buyers from across the world including, but not limited to, China, Korea, Japan, Canada, Qatar, Saudi Arabia, UAE and Norway. The ‘Core Coastal Cities’ will continue to be driven by this demand. In addition, we expect a strong performance from the ‘Momentum’ cities that have an attractive mix of attributes for creative and tech industries and the associated real estate asset classes, including Austin, Miami and Denver.

Increasing interest in wider Europe

In Europe, the European Union revolution is over and the threats of collapse are now fading into the distance. The region is beginning to show wider and more stable economic growth and along with modest inflation expectations and a low interest rate environment, investors are increasingly looking wider than the core locations of London, Paris and the main German and Nordic cities. Gradually more global investors will be looking to Central & Eastern Europe as these markets look more attractive not only on a relative pricing basis but also due to improving fundamentals. We continue to like the Super Cities and in particular look to the new neighbourhoods being created by limited core stock and tenants looking for value and ‘interesting’ locations. However, given the maturity of the cycle, we are watching closely for signs of overdevelopment. Looking to the UK, it appears that many investors have, for now, shrugged off the results of the European referendum. In reality, Brexit means different things to different groups and some investors are looking to Europe but are actively excluding the UK while others such as many Chinese and Hong Kong investors appear laser-focused on UK real estate.

“The combination of strong demand, lower levels of supply and higher frictional costs of trading and/or holding real estate will lead to growing instances of structured sales”

Momentum in Asia

In Asia, economic conditions are stabilising with commentators expecting China to show moderating rather than collapsing growth and Australia recording continued progress in transitioning away from a mining led economy. Indeed, the Australian market remains a favourite with investors looking for exposure to the region with low vacancy rates in Sydney offices driving rents forward and spurring increasing interest in value-add opportunities and Melbourne maintaining significant momentum. The main Indian cities are also seeing increasing interest from global investors and commercial developers driven by improving occupier markets. The recent liberalisation of several provisions of Indian REIT regulations means that we could see the first listings soon; a development that would greatly augment transparency and governance in the country. We also see possible early signs of some market turning points such as in Singapore where the residential market and in particular the outlook for collective sales appears to be improving. In China, we expect robust domestic investor demand as capital controls keep some of the cash at home. In addition, we continue to see increasing interest in China from larger global investors attracted by the increasing liquidity and transparency of the real estate sector and economy with the core cities and sectors the primary beneficiary; although it remains too early for many.

Evolving approaches to investment

Structured deals

A theme we expect to see evolve in the new investment environment are increasing instances of structured sales as both vendors and purchasers look for innovative ways to assemble ownerships. While this is fairly commonplace in some markets due to dynamics such as lot size, development expertise or taxation rules (such as FIRPTA), we expect it to become more widespread across investors, locations and lot sizes. The combination of strong demand, lower levels of supply and higher costs of trading and/or holding real estate will lead to growing instances of these structured sales i.e. institutions and other investors selling parts or shares of assets in order to release capital while retaining exposure to the asset and at the same time protecting their asset management fee. This process also allows a buyer to gain exposure to assets and sectors that may ordinarily be outside of their fund size or sector skill set.

Consolidation of managers

While the pool of investors in real estate continues to grow as new market entrants appear, we also see further consolidation of existing investor types. In particular, the fund management community is seeing continuous margin pressure due to issues such as the increasing popularity of cheaper passive vehicles and this is likely to lead to further M&A activity in the sector. In addition, those that have merged over the last few years will continue to restructure their portfolios and this ‘housekeeping’ is likely to be a source of some asset sales.

Local/global approach

We also expect to see more local developers and asset managers leverage their expertise to support global investors that do not have the required local-market skills. This will both be the new market entrants who are looking to this expertise to guide them through a purchase and/or development process or, increasingly, investors who have bought secure-income properties over the last 10 years who are now facing shorter leases and an aging asset.