The world of property is becoming inexorably interconnected across continents as a result of increasing trade and ownership of overseas assets. What trends do we expect next?

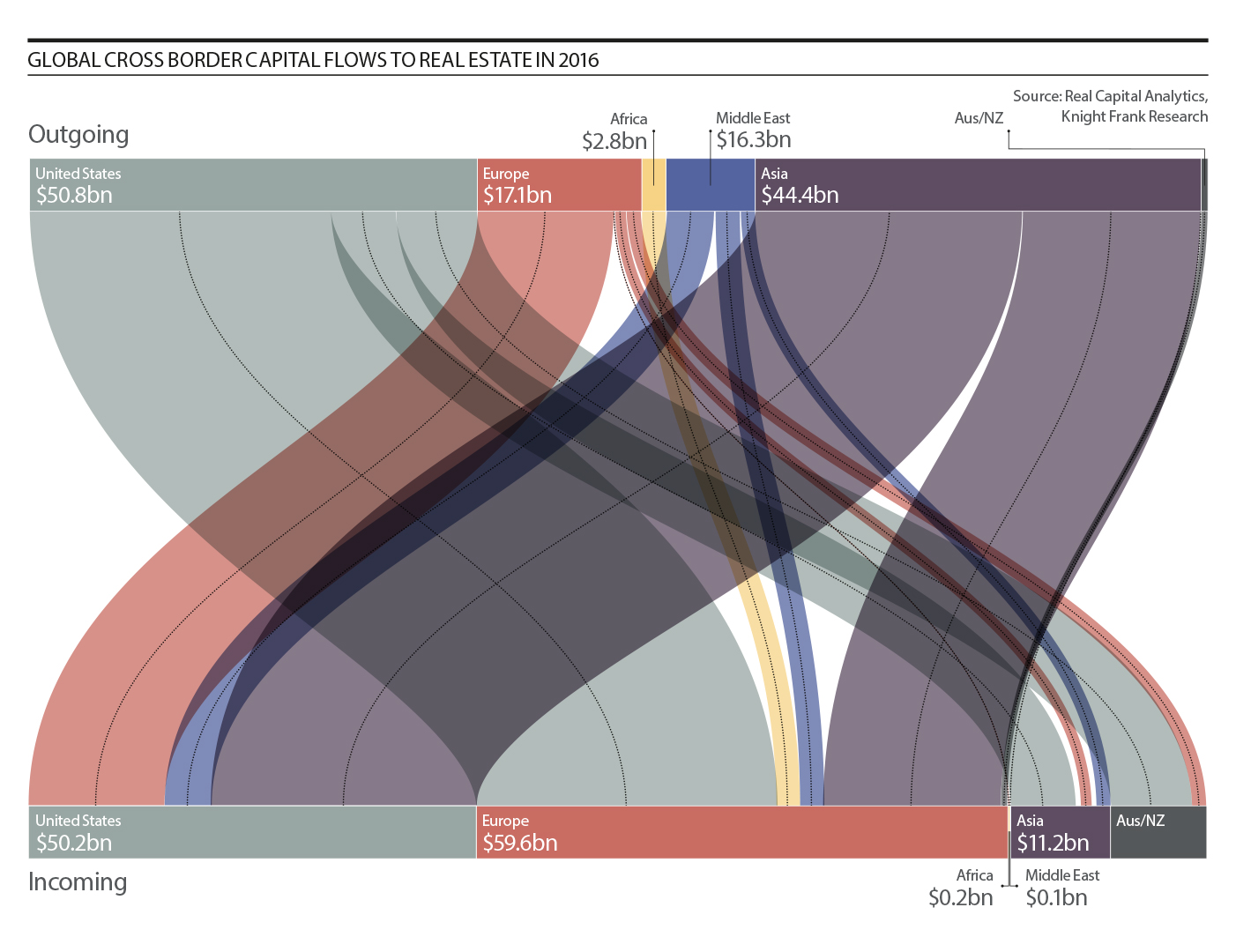

Investors are increasingly searching the globe for yield in this low return environment, but this is only part of the story; the requirements of security of income, liquidity and diversification are equally important, as are the ambitious corporate business plans of those looking to build global platforms. Underpinning this, and a key part of the recent wave of global capital activity, is an increasingly open outlook from a number of governments, such as China and Taiwan, who have loosened restrictions on overseas investment at the same time as many investors have increased target real estate allocations.

Even as the economic environment shifts, we believe the globalisation of real estate will continue to accelerate. As more deals are completed, transparency is further improved and advisors become more globally connected; driven by property owners and investors requiring guidance for navigating this increasingly complex and growing world of diverse capital requirements and geographies. Plus, the peers of the early-mover investors are enthused and emboldened to transact themselves.

“The globalisation of real estate is selfperpetuating and is accelerating”

The impact of technology as an enabler in this process cannot be underestimated either. Facilitating accelerating transparency through aspects such as the availability of data and deals information, improving global communications, making travel easier plus influencing aspects such as capital raising and fund administration.

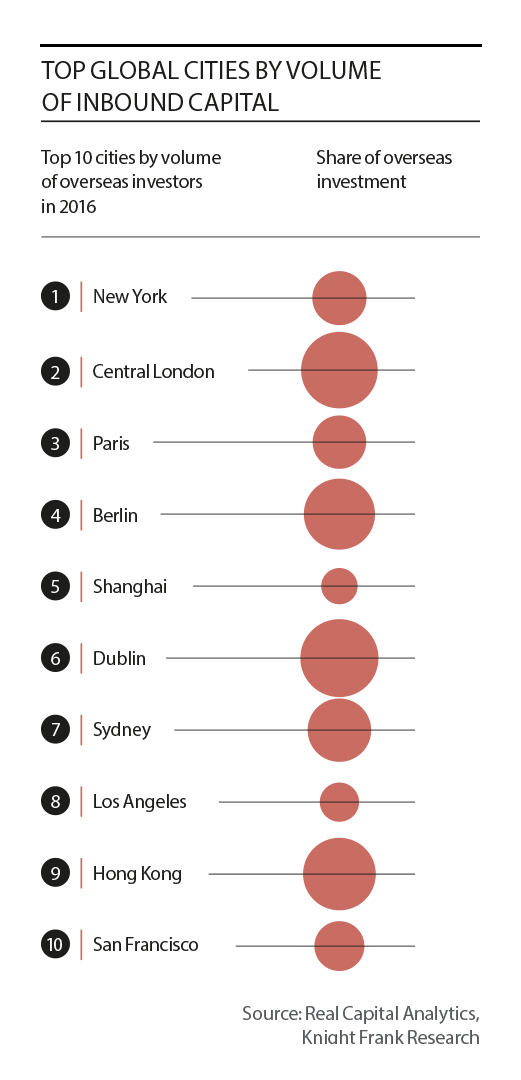

The super cities: Truly global asset markets

For many gateway cities, and especially our global Super Cities, overseas investment is now a significant part of the transaction flow and ownership structure. For hubs such as London, New York and Paris this is by no means a new trend and cross-border buyers have been active in these markets over a number of cycles. However the sheer weight of global capital and the diversity of buyer types, from institutions to sovereign wealth, private equity, developers and private individuals is deeper than ever before. Each of these groups have their own specific dynamics including cost of capital, hurdle return rates, hold periods and sector preferences. This can make for a very deep and competitive market and one in which the traditional domestic player increasingly has to adjust its investment mind-set to make the most of the entry and exit strategies of these new pools of capital.

Opportunities and challenges

This evolution of the global real estate marketplace brings with it a multitude of opportunities both for the investors and the destinations of the capital. Increased funding, improved liquidity, greater transparency and innovations across both the capital stack and the assets themselves can all be driven by incoming investment.

However, global investment and ownership of commercial assets are not without their challenges and opposition. While overseas residential property ownership captures the public zeitgeist and therefore much political attention, increasing commercial ownership and capital flows (both inbound and outbound) are also in focus across some geographies. This opposition can manifest itself in many ways including taxes on transactions and ownership, structuring rules and, as we have seen in the case of Chinese outbound investors, capital controls. With these issues increasingly on many investors’ radars we continue to monitor both the regulatory environment and the potential market implications including a slowing of trading volumes as complexity and friction costs of dealing increase.

Direction of travel

As we enter what we see as a new stage of the global economic cycle, active capital flows are likely to change direction and emphasis. We expect more interest in emerging market locations as mature locations see performance moderating and opportunities becoming harder to find with owners moving from a ‘trading’ strategy to holding assets for longer.

At the same time, investors from emerging markets that have been attracted to developed economies by the positive currency arbitrage or due to weak performance in their own markets are more likely to be persuaded to stay nearer home as domestic conditions improve and foreign exchange movements shift out of their favour.

Overall, whilst we believe that the weight of capital from a particular geography will ebb and flow depending on domestic market and economic conditions, we remain confident that there will be additional educated and well-travelled investors from other locations that have the ability and appetite to take their place in the search for appropriate risk and return in the global real estate marketplace. The Super Cities and other gateway locations will continue to attract significant capital but domestic players may, for the first time in a while, get to play ball as some global investors shift their focus.