by Taimur Khan

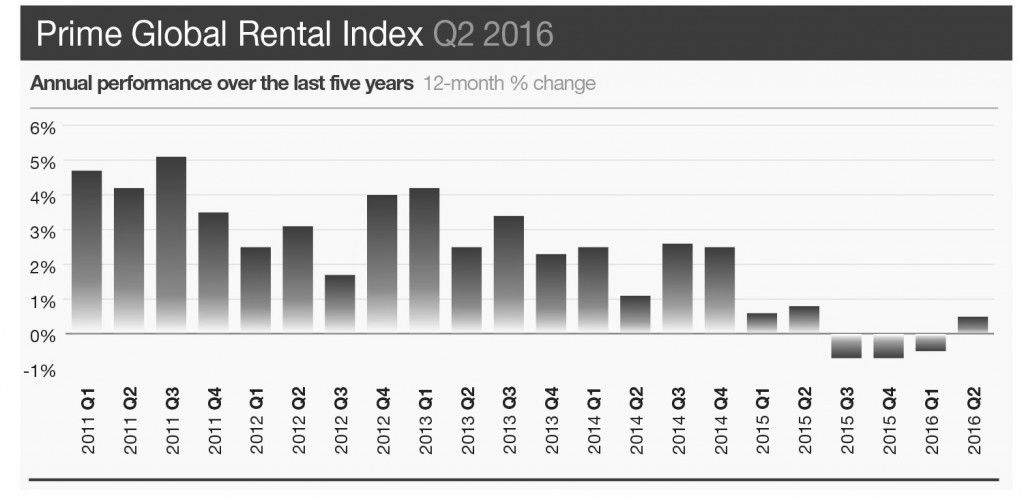

Knight Frank’s Prime Global Rental Index, which tracks the change in luxury residential rents across 17 cities globally, recorded annual growth of 0.5% in the year to June 2016.

The number of cities where rental growth has increased rose from seven in the previous quarter to ten this quarter.

Moscow holds the top spot, with prime rents rising by 11.1% year-on-year. Sizable infrastructure investments in the city, combined with a marked slowdown in the contraction of the national economy and substantial gains in oil price over the last quarter have underpinned rental growth.

Nairobi continues to be the weakest performing market with prime rents falling by 9.2% annually. Since Q3 2011 Nairobi has recorded annual prime rental growth of 9.7% on average, the market is now looking to rebalance.

Whilst uncertainty caused by Brexit and the US presidential election still lingers, we are starting to see a more positive global economic landscape develop. Sustained and positive economic data from the US, growth in emerging markets led by easier access to credit markets and increased demand from China for commodities suggest a positive outlook for the remainder of 2016. For prime rental markets these factors are likely to stimulate demand from corporate tenants.