Knight Frank Thailand reveals that the super prime condominium markets in Bangkok and London are becoming one of the most burgeoning property segments, attracting local and international ultra high net worth individuals (UHNWI) and investors who purchase such properties as their second home. With demand for super prime condominiums in these cities continuing to skyrocket, prices are unquestionably increasing by leaps and bounds.

Mr. Frank Khan, Executive Director, Head of Residential Department, Knight Frank Chartered (Thailand) Co., Ltd., has shared Knight Frank’s insight on the property market in Thailand, saying that the super prime condominium segment in Bangkok has grown dramatically over the past 3 to 5 years. This superb bracket was first introduced in Thailand in 2008 with the launch of Sukhothai Residences, located on Sathorn Road, as the first super prime development.

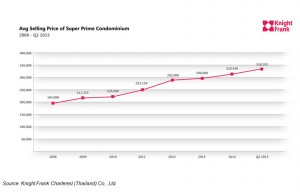

Mr. Khan reveals that the average selling price of super luxury condominiums in Bangkok’s CBD areas has climbed up from 184,000 baht per square meter to nearly 400,000 baht per square meter in mid-2015, adding that a continuous growth in price is due mainly to the non-availability of land for the development of a high-rise residential project in each and every CBD area, be it in Sukhumvit, Rajadamri, Silom, Sathorn, Saladaeng, Langsuan, Ploenchit, Chitlom, or Wireless Road. “So, whatever project is coming in these areas, it would have to be high-end, superb, super prime condominiums, making the prices extremely high,” said Mr. Khan.

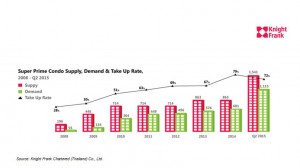

At present, this super prime segment represents only 1 percent of Bangkok’s condominium market with a total of 8 super prime condominium projects spanning across Bangkok’s CBD. According to Knight Frank Research, the current supply of super prime condominiums in Bangkok stands at 1,541 units, compared to 196 units in 2008. Central Lumpini outperforms other CBD areas in terms of supply, contributing 33 percent or 508 units out of 1,541 units, followed by Sathorn, accounting for 25 percent, Sukhumvit (22 percent) and Riverside (20 percent).

Super prime condominiums are sold as ‘lifestyle products’ with large and full services equivalent to or provided by 5 to 6 star hotels, said Mr. Khan. They are highly luxurious and spacious in size with a minimum price per unit being sold at 15 to 20 million baht. Their unit types usually range from 2-bedroom to 3-bedroom units. There was a 1-bedroom unit type launched earlier between 2013 and 2014 as well, but it was as considerably spacious as other unit types. Located in a high-rise building, these super prime condominiums offer world-class facilities and ample car park space. They are also predominantly managed by international 5-star hotel chains. Convenience is a key ingredient to super prime condominiums as buyers yearn for proximity to international hospitals, international schools, high-end shopping and dining destinations.

Mr. Khan also pointed out that London illustrates a similar living trend with the super prime, high-end condominium market continuing to flourish. The 2 to 3-bedroom units with a total space of 900 to 1,200 square feet (90 – 120 sq.m) prevails in the market, especially in notably prime central areas like Kensington, Knightsbridge, Westminster, Belgravia, Hyde Park, and Notting Hill.

Prices of super prime condominiums in London have risen more than 20 percent over the past 5 years, reaching 2,200 to 2,900 pounds per square foot at present.

As well as prime central London, the fringe areas like Tower Bridge, King’s Cross, Waterloo, Canary Wharf are growing very fast and becoming the new hot spots for super prime projects in the near future thanks to Crossrail, a 2-billion-pound mega transport infrastructure, scheduled to be completed in 2018. “It is a shortcut from these fringe areas to CBD like Bond Street and Oxford Street, taking only 15 minutes in contrast to 45 minutes today,” said Mr. Khan.

Knight Frank Residential Research forecasts that, between 2015 to 2018, prices in prime central London will soar 22 percent while in prime outer London will experience the same amount of growth at 22 to 23 percent.

Mr. Khan added that the entire property market in London will continue to perform very strongly because of high demand in proportion to low supply. Knight Frank Research shows that right now average annual supply of houses in London stands at 35,000 while there is a thriving demand of up to 50,000 houses. “When demand is high, but supply is low, everybody wants to be a seller, so London is now becoming a very aggressive market,” said Mr. Khan.

Mr. Khan concluded that Bangkok’s super prime condominium market will not be affected by the advent of the Asean Economic Community (AEC) in late 2015. AEC will, fortunately, drive growth in the rental segment thanks to an influx of human resources within the region, relocating themselves to Bangkok, in particular and looking to rent B+ to A-grade apartments.