Miss Risinee Sarikaputra, Director, Research and Consultancy at Knight Frank Chartered (Thailand) Co., Ltd., revealed that the new office property space in Bangkok enjoyed a high occupancy rate in a short period of time. Also, it is interesting to note that the rental asking price for Grade A office space outside of the Central Business District (CBD) was higher than that of Grade B space within the CBD, thanks to the development of new offices with high standards and convenience in terms of access to the transportation infrastructure.

From the research results of Knight Frank Charterd (Thailand) Co., Ltd., it was found that, in the first half of 2015, the net take-up of office space was approximately 133,359 square metres, resulting in a cumulative supply of 4,318,382 square metres from 4,661,188 square metres. From the end of 2014, the occupancy rate rose from 91.5 to 92.6percent. At present, there is merely 342,806 square metres of vacant office space. In 2015, there was just one new office building launched, namely, Bhiraj Tower, which is on Sukhumvit Road and next to the EmQuartier complex. It offers around 47,500 square metres of lettable space and about 70 percent has been reserved by companies. In the first half of 2015, there was a take-up of 55,945 square metres of space in the CBD; outside the CBD, there was a take-up of 77,414 square metres.

Figure 1: Demand, Supply and Occupancy Rate for Bangkok Office Space, 2011 to Q2 2015

Source: Knight Frank Thailand Research

On the whole, the newly occupied space was in newly completed buildings or buildings with a lot of vacant lettable space. This space was rented by companies with existing operations who wished to expand and found that their previous office space did not allow for such expansion. They thus has to move. Newly completed buildings included AIA, The Capital, SJ Infinite, and Bhiraj Tower at EmQuartier. It could be seen that the occupancy rate of newly completed buildings was high in a short time frame. Even though companies moved out of their old spaces in the CBD, the overall occupancy rate for office space did not drop due to the fact that companies remaining in such spaces also expanded their operations.

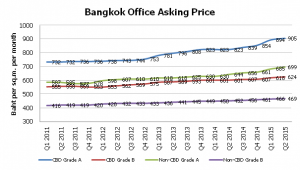

Figure 2: Asking Price

Source: Knight Frank Thailand Research

Miss Risinee added that, in terms of the average asking prices for office space, it is currently 674 baht per square metre, which reflected an increase of 7 percent compared to the first half of 2014. The rental rate in the Grade A-CBD group commanded approximately THB 905 per square metre, while that of the Grade B-CBD group was THB 624 per square metre. In the non-CBD group, the asking rates were 699 baht per square metre and 469 baht per square metre in the Grade A and Grade B sectors, respectively. It can be noted that the asking price for Grade A office space outside of the CBD was higher than that of Grade B space within the CBD. Moreover, the difference in asking prices for Grade A-non CBD spaces and Grade B-CBD spaces is increasing, thanks to the development of new non-CBD offices with high standards. In contrast, Grade B-CBD offices saw no improvements. Also, Grade A-non CBD spaces enjoyed more convenience in terms of connectivity and access to the transportation infrastructure.

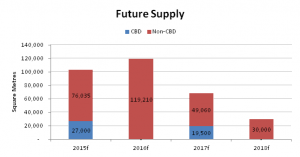

Figure 3: Future Supply

Source: Knight Frank Thailand Research

As for the future supply of office space, it looks like this will increase more in non-CBD areas. Buildings under construction in the CBD incude just 120,143 square metres of space, while there is 250,210 square metres of non-CBD office space under constuction. In 2015, the following buildings are scheduled for completion: G Land Tower in the Rachadapisek area, AIA Sathorn Tower on Sathorn Road, and Major Tower on Sukhumvit Road (Soi Thonglor).