Miss Risinee Sarikaputra, Director, Head of Research and Consultancy, Knight Frank Chartered (Thailand) Co., Ltd., revealed that the selling price of new super prime projects in Phuketlaunched in 2015, are between USD 7.5 million to 15 million a unit. The resale price of super prime propertiesis USD 20 million a unit this year. Ms. Risinee added that the price of the new super prime project has increased by 120% from such projects that were launched between 2007 and 2011.

According to Knight Frank Thailand Research, no new super prime projects in Phuket were launched between 2012 and 2014. However, the selling price of the super prime projects, launched between 2007 and 2011 and available for sale in 2014, were sold from USD 3 million to USD 7 million per unit.

Table 1: Selling Price of Selected Super Prime Projects in Phuket

| Project Name | Launched | Selling Price per Unit**(Million THB ) | Selling Price per Unit** (Million USD) |

| Andara Signature | 2011 | 192 – 250 | 5 – 7 |

| Amanpuri Phase II | 2011 | 208 – 350 | 5.8 – 9.8 |

| Banyan Tree | 2008 | 100 – 125 | 2.8 – 3.5 |

| Malaiwana | 2006 | 99.5 – 128.5 | 2.7 – 3.5 |

| Istana* | 2007 | 127.5 – 253.5 | 3 – 7 |

| The Estate at Mont Azure | 2015 | 266 – 532 | 7.5 – 15 |

| Avadina Hills | 2015 | 355 | 10 |

*Project is on hold.

**The above price is the developer’s selling price; it is exclusive of re-sales prices

Source: Knight Frank Chartered (Thailand) Co., Ltd.

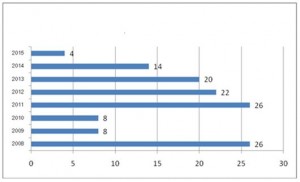

Table 2: Number of Super Prime Units in Phuket Sold in 2008 – 2015

Source: Knight Frank Chartered (Thailand) Co., Ltd.

Ms. Risinee said the majority of super prime project buyers in Phuket are expatriates based in Asia, particularly in Hong Kong, Singapore and Shanghai. For the most part, these buyers have lived and worked in the region for a number of years and tend to know Phuket well by having spent holidays on the island. The emerging buyers are Australians, French and Canadians, as well as Asian travellers. Buyers acquire super prime properties as their second home, holiday place or retirement residence. They are most often owners of a property elsewhere, and in many instances, they own two or more properties throughout the region and world. Such buyers tend to be emotionally involved in the purchase and like to visit the site and be familiar with the area prior to reserving a unit, which can lengthen the buying process. Ms. Risinee also noted that the average amount of time from start to finish of the sales process in Phuket is over one year. Location is a key factor for sales, and people pay a lot of attention to the site, views and immediate environment, including other developments and the availability of amenities.

Luxury property in Phuket encompasses the villa with a selling price of over THB 100 million a unit; these are mostly oceanfront villas managed by international branded hotels. The villas under this category mostly offer over 4-bedrooms, with spacious living, dining and entertainment spaces. They also provide world-class leisure facilities, with a private gym, spa room and private pool. The villa’s usable area is over 1,000 square metres, and they are located on over 2 rai (or over 3,200 square metres) of land. Moreover, they reflect an excellent standard of construction using high-quality materials and specifications, a functional layout, ample privacy for residents and premium decoration.

Notes to Editors

Knight Frank LLP is the leading independent global property consultancy. Headquartered in London, Knight Frank and its New York-based global partner, Newmark Knight Frank, operate from 417 offices, in 58 countries, across six continents. More than 13,000 professionals handle in excess of US$1.4 billion worth of commercial, agricultural and residential real estate annually, advising clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit www.knightfrank.com.