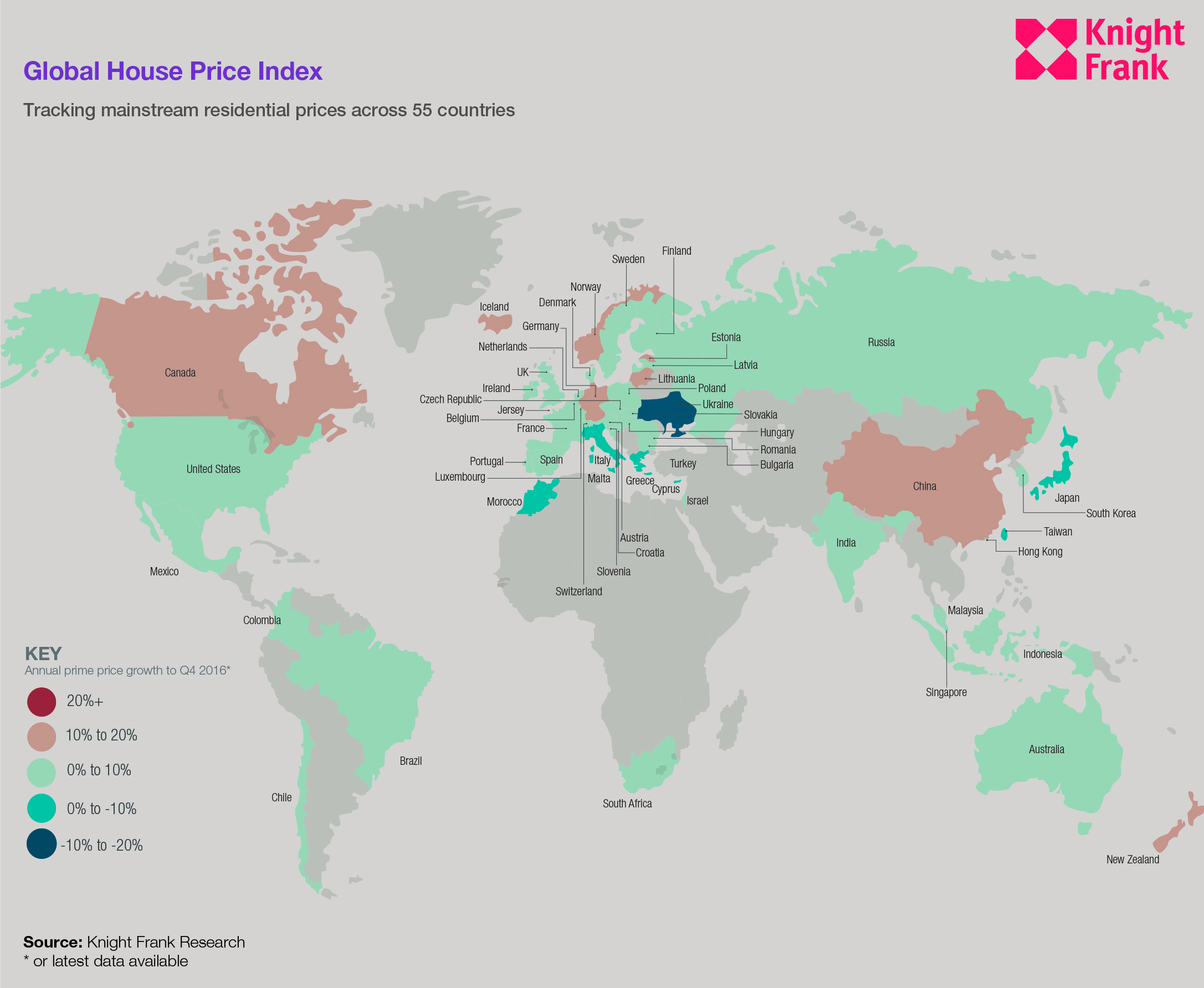

Knight Frank, the independent global property consultancy, today launches the Global House Price Index* for Q4 2016. The index monitors and compares the performance of mainstream residential markets in 55 countries across the world, 11 of which are from Asia-Pacific. Globally, the index grew by 6.0% in 2016, up from 5.3% in the previous quarter and 4.1% in 2015. It is the highest annual rate recorded since the first quarter of 2014.

Results for Q4 2016

- Iceland leads the ranking for the first time since the index began in 2006.

- China jumped from 43rd position in the rankings in 2015 to 7th in 2016 with average prices now increasing by 10.8% per annum according to the country’s National Bureau of Statistics.

- Ukraine, Taiwan, Singapore and Cyprus continue to be characterised by weak growth either due to ongoing geopolitical crises, economic fragility or cooling measures which are artificially restraining growth.

- Long-term frontrunners, Turkey (12.2%) and Sweden (6.1%) both saw their rate of annual growth decline.

Nicholas Holt, Head of Research for Asia-Pacific, Knight Frank Asia-Pacific, says, “New Zealand, the strongest performing market in the Asia-Pacific region, is seeing price growth moderate after a number of quarters of upwards momentum. However, with the market still suffering from supply shortages, we believe overall growth will remain positive throughout the year.

“In Asia, the most notable market was Singapore where the surprise slight easing of certain cooling measures is likely to spur some additional interest in the market. Still sitting close to the bottom of the chart, many buyers in Singapore are still constrained by the Additional Buyer’s Stamp Duty and lending restrictions.”

Kate Everett-Allen, Partner, International Residential Research, adds, “The growth rate in the US increased compared with last quarter, whilst the UK drifted lower.

“The overall picture is one of stable or rising prices, despite the global landscape of political and economic uncertainty. The number of housing markets recording price rises has increased from 43 in 2015 to 47 in 2016. With higher inflation and diverging monetary policies expected in 2017, we may see a widening gap between the strongest and weakest performing market.”