This year may have delivered a series of political surprises, but these have had a limited effect on the housing market so far. As we move into 2017, economic uncertainty may weigh on the market, but it is property taxes which continue to shape the residential landscape, as well as the under-supply of housing and ultra-low mortgage rates.

These themes are investigated in full in the Residential Market Update.

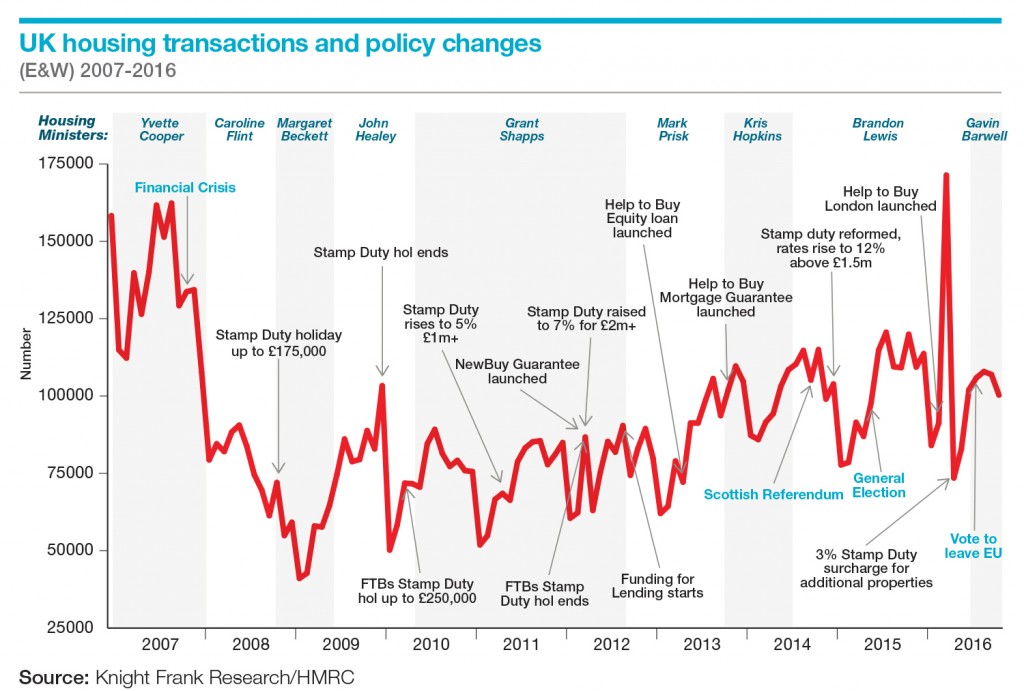

Nowhere was the influence of stamp duty more apparent than earlier this year when the introduction of an extra 3% surcharge for the purchase of additional homes in April caused a surge in activity in March. This can be seen from the chart below. The chart also illustrates that the housing brief has been passed around a bit, with nine ministers in ten years. The current minister, Gavin Barwell, will produce a comprehensive White Paper on the housing market, due to be published in January. This is a consultation paper, but will go far to giving a steer on the government’s plans for the market, especially boosting new-build supply.

The shortfall in new housing and second-hand housing for sale, as well as ultra-low mortgage rates are underpinning the market at present, although overall average house prices growth is slowing modestly across the UK.