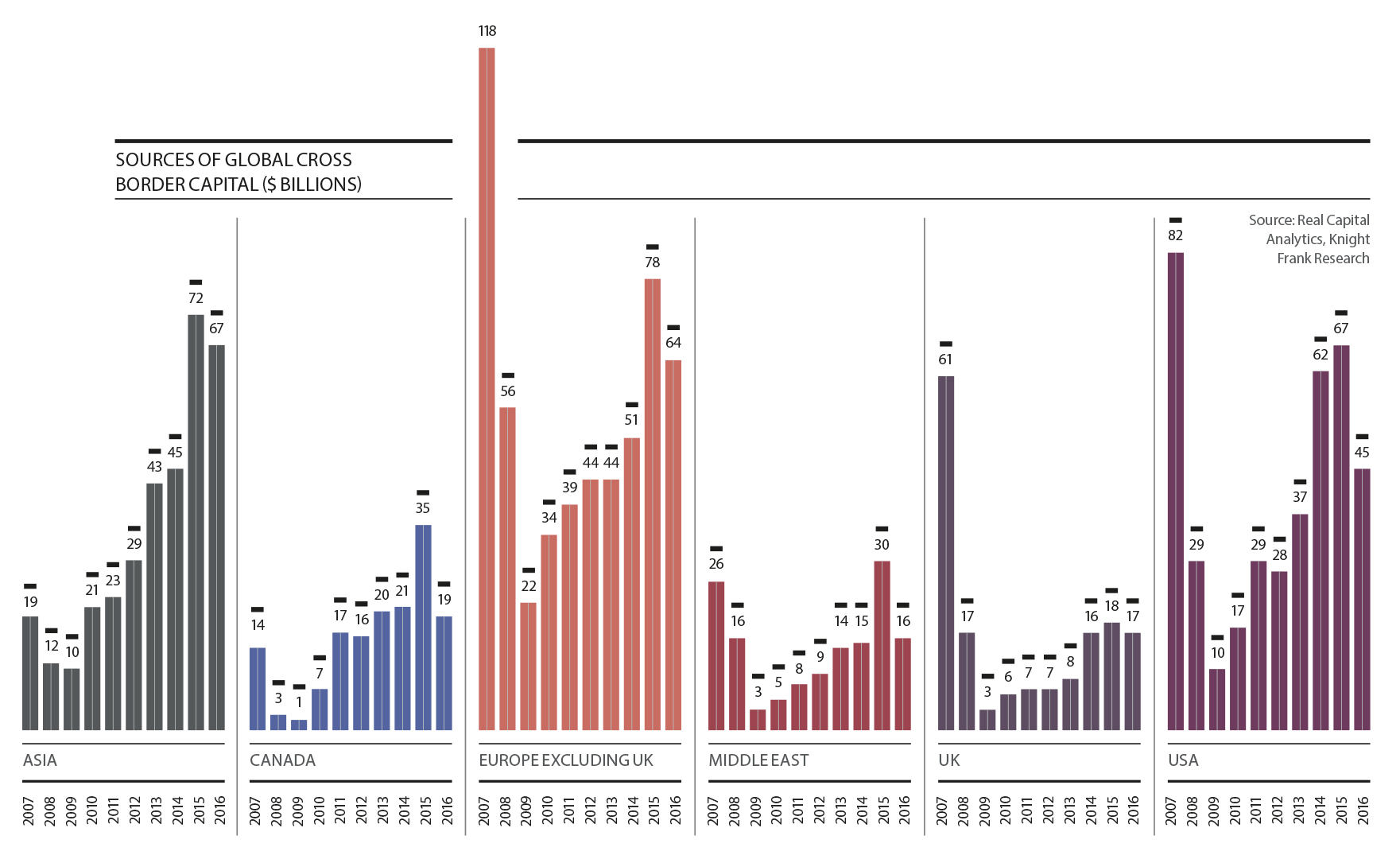

Cross-border volumes recovered rapidly following the global financial crisis. However, the pattern has changed somewhat from the trends seen in the previous cycle and new entrants have emerged.

While some sources, such as the UK, have remained largely domestically focused so far this cycle, preferring to concentrate on the improving occupier and capital markets locally, others have looked further afield. The clear stand-out are investors from Asia who have launched themselves onto the global stage over the last few years to become one of the most important global capital exporters and, increasingly, owners of real estate in gateway cities.

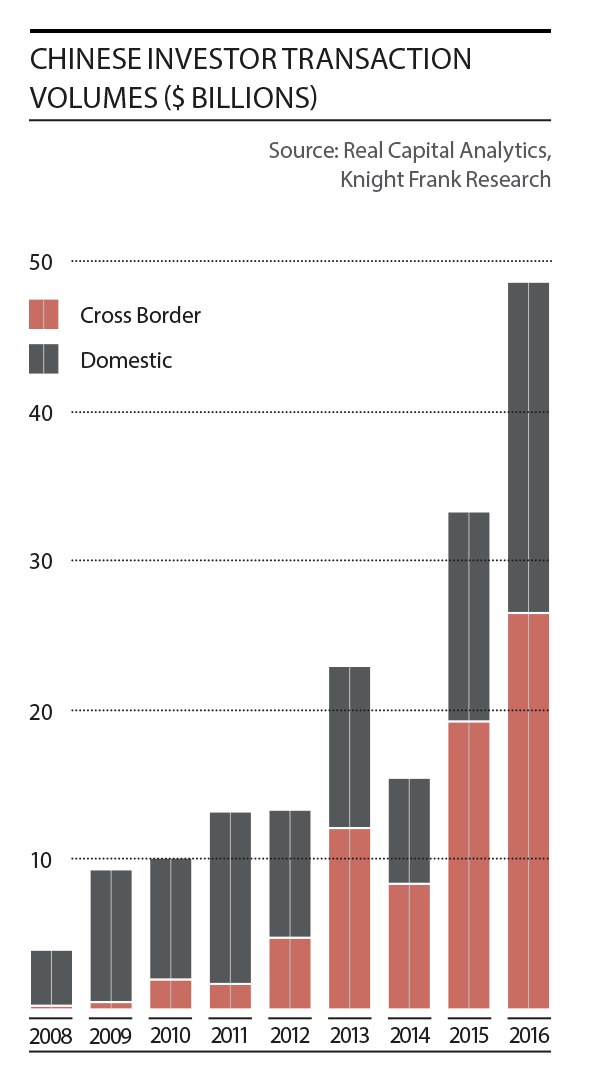

Chinese capital

Chinese capital has been a key driving force behind global real estate transaction volumes over the past few years, especially across our Super City markets. Despite recent geo-economic uncertainties around the world, Chinese appetite for mega-assets seems insatiable.

However, some target locations are beginning to feel uneasy around the sustainability of Chinese investment as questions are being raised on the government’s latest capital outflow controls and the health of the domestic economy.

While North America, parts of Europe, the Middle East and more recently China are dominating global outbound flows, we are following increasing activity from locations such as Japan, Taiwan, Korea, Singapore, France, Africa, Latin America and from investor groups such as Sovereign Funds and Private Wealth.

Observations from David Ji, Head of Research Greater China

1– The latest Chinese GDP growth figure, 6.9% YoY growth in the first quarter this year, seems to have dispelled doubts on the country’s overall economic health. Some of the previous concerns, such as the domestic home inventory glut, paled in comparison with impacts of external surprises like Brexit and the US election result. Even those shocks have now been gradually digested as investors have taken advantage of factors such as exchange rate dips.

2– Only a couple of years ago the global marketplace was crowded with big name Chinese insurance firms, large developers and State Owned Enterprises (SOEs). However, since 2015 we have seen more determined advances, even dominance in some markets, by private conglomerates or developers including HNA, Fosun, R&F etc. Compared to their SOE counterparts, this group of investors and developers are far more nimble and are able to make decisions more quickly. Instead of heeding a coordinated national drive as with the SOEs, they have grown more sophisticated in their own strategies and calculations for projects. We expect to begin to see less of a rush for trophy assets and more methodical behaviours that are commonly observed from mature players.

3 – Currency fluctuations including the appreciation of the dollar, yield shift, as well as recent significant asset price inflation will be amongst the risks they consider. And as the Chinese capital outflow controls persist, companies that lack previous overseas exposure and those with core business not in property will find it difficult to obtain foreign exchange clearance from the authorities. However, firms with Hong Kong or Singapore listings or subsidiaries have been able to raise funds as well as launch their bids from these financial hubs. Despite this, we may see transaction volumes from China reducing in some markets in the short term.

This reduction may well prove to be temporary as we expect that the capital controls will be loosened as the Yuan exchange rate improves and GDP growth continues on a steadier path. The government policy conference later in the year will also reaffirm the country’s expansion strategies. Indeed, there are signs of this happening already. It was reported in April that the required balancing of inflows and outflow of cross-border Renminbi payments by financial institutions has been verbally lifted.

As for key markets to look out for, Chinese investors still focus on gateway cities such as London, New York and the other Super Cities given their stability and depth. Other key locations including cities on the “Belt and Road” route, e.g. Singapore and key Southeast Asian hubs, will also attract significant investor interest.

Japanese capital

We expect that Japanese investors will be an important part of the market over the next two years. Outbound M&A investment from Japan has seen a significant increase recently as Japanese companies look to diversify away from a mature domestic market. High profile deals such as SoftBank Group’s acquisition of ARM Holdings, the UK-based chip design firm, capture the headlines but there is a deep pool of capital and deals, both corporate and real estate, underway. We are seeing increasing activity from groups such as Mori Trust, Japan Post Bank, Takenaka and GPIF, the world’s largest pension fund, who have recently set out a global real estate investment strategy following a major shift in policy in late 2014 that allows the fund to include alternative assets as part of its portfolio.

Drivers of this recent push into global real estate include low economic growth rates and a falling and aging population at home as well as negative interest rates and significant cash reserves. Japanese investors, both retail and institutional, are broadly seen as conservative and currently have more than 50% of financial assets in deposits and just 5% in investment trusts but government policies are encouraging investors to shift to investment products. Recent data from AMP Capital estimates that Japanese institutions have approximately USD4.4 trillion under management; a 5% allocation would see USD230 billion of capital directed towards global real estate.

In addition, the vast majority of corporate pensions, public pensions and financial institutions are arranged as defined benefit schemes which favour higher yielding real assets such as real estate. Given all of these factors plus a relatively illiquid domestic market, especially in core locations such as Tokyo, we see compelling reasons to expect cross-border flows to pick up further.

Sovereign investors

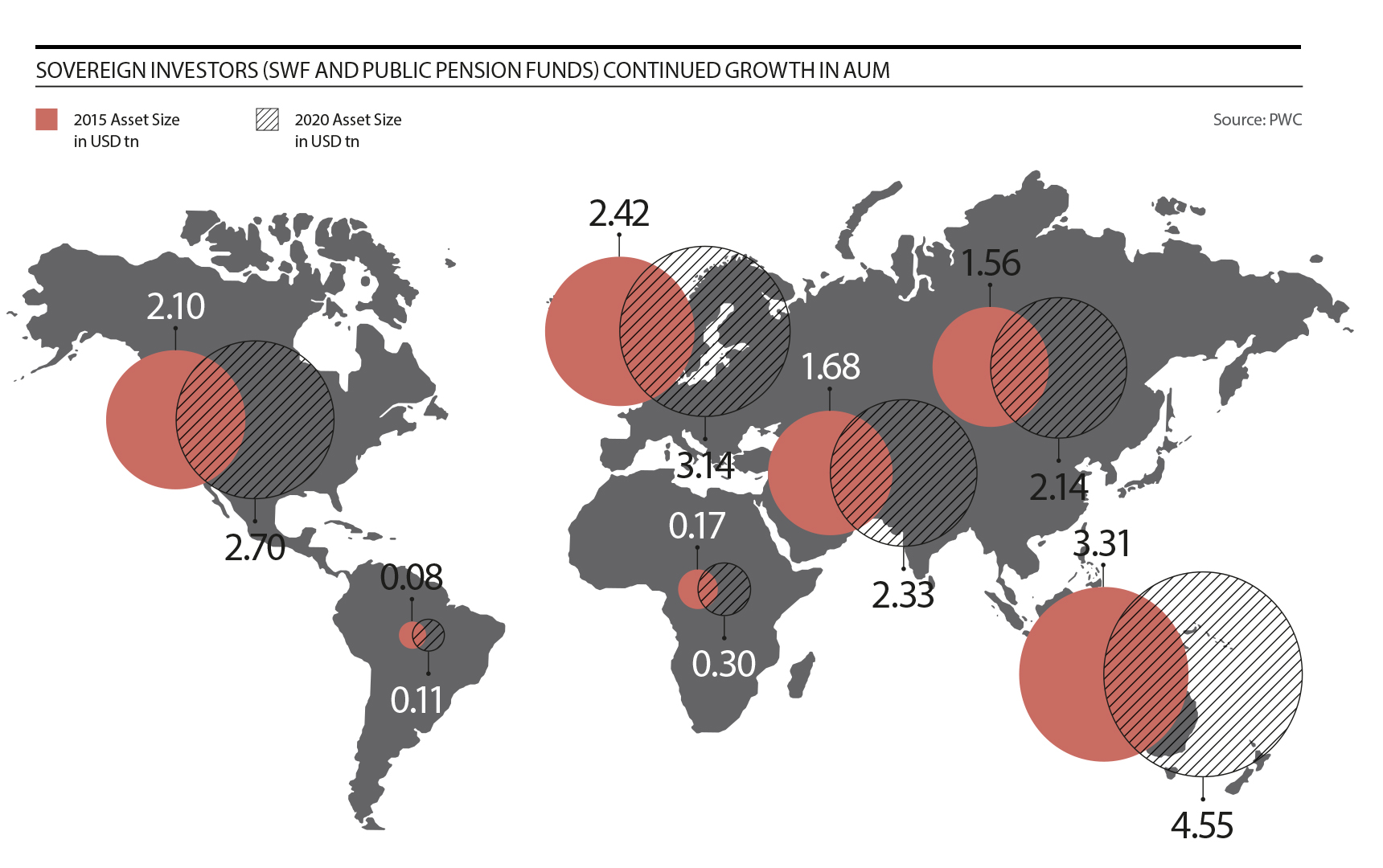

Sovereign funds continue to build allocations in global real estate. Data from Prequin shows how Sovereign Wealth Funds’ total assets under management now exceed USD6.5 trillion having risen from USD3.1 trillion as recently as 2008 as governments continue to drive funding as well as from returns generated from the rising AUM. This rises to over USD11 trillion if you include assets managed by Public Pension Funds.

At an individual level, many of these investors have huge volumes of assets under management, either from raw material reserves or pension funds, but historically have had very limited exposure to real estate. With such large funds, just a small change in allocation can create requirements of significant scale. In many cases the volume of transactions and subsequent asset management can quickly necessitate building local market expertise and management functions.

Despite uncertainty over oil prices, many of these funds are expected to continue to grow. PwC are forecasting sovereign investors’ assets to reach over USD15 trillion by 2020 reflecting a CAGR of 6.2% and also believe a number of new funds will be set up. Calculating a 5% allocation suggests a possible additional allocation to real estate of USD185 billion by 2020 without factoring in the current underweight position.

This combination of increasing capital under management plus bigger target weightings towards real estate translates into very significant dry powder searching for suitable global prime real estate opportunities and will make them increasingly important landlords in even the largest markets.