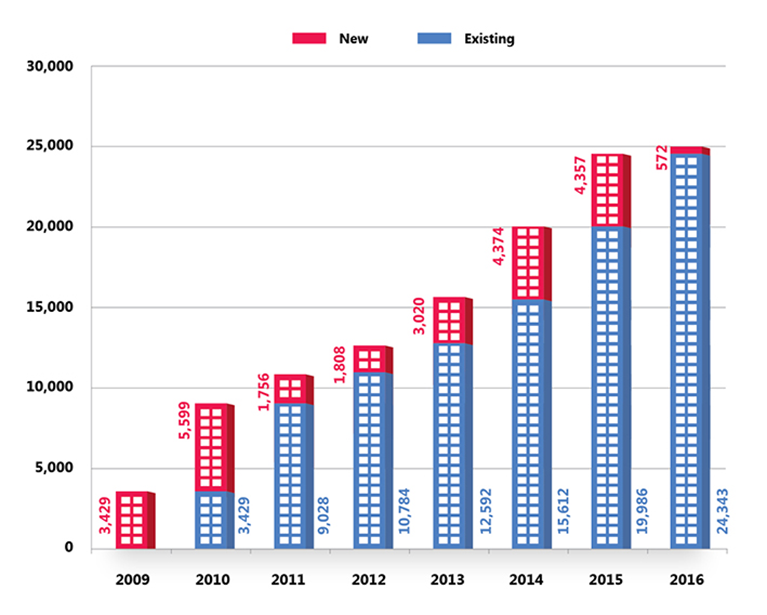

Mr. Phanom Kanjanathiemthao, Managing Director, Knight Frank Thailand Co., Ltd., revealed that the real estate market in the Ladprao – Chatuchak – Kaset – Paholyothin area has the liklihood of positive growth. The existing supply in the market is small, and there is little left to sell. This is because few projects were launched last year. In 2016, the new supply consisted of only 570 units, which added to the existing available supply of around 2,000 units and around 2,000 to 3,000 resale units. At the end of 2016, the supply in the area was about 24,900 units. There were approximately 22,800 units already sold, representing a cumulative sales rate of 91.5 per cent, which is considered to be high. This is likely a result of the public transportation development of the Green Line Extension of Mochit-Khukhot that is expected to launch a trial service at the beginning of 2020.

Figure 1: Supply and New Supply of Condominium Market in Ladprao – Chatuchak – Kaset – Paholyothin – Vipavadee Area, 2009-2016

Source: Knight Frank Thailand

Figure 2: Supply – Accumulated Demand and Sales Rate of Condominiums in Ladprao – Chatuchak – Kaset – Paholyothin – Vipavadee Area

Source: Knight Frank Thailand

It was found that, at present, the price of a newly launched condominium in the area had an average sales price of 118,146 baht per square metre. When looking at projects launched within the past three years, the average sales prices increased every year. This is due to the fact that more Grade A condominiums were launched in the vicinity of Chatuchak Park.

Figure 3: Price Levels of Newly Launch Condominiums in Ladprao – Chatuchak – Kaset – Paholyothin – Vipavadee Area (Baht per Square Metre)

Source: Knight Frank Thailand

Mr. Phanom added that the potential of the area lies with the promising development and expansion of commercial projects such as the current Metro Green Line Extension project. In addition, there is the development of State Railway of Thailand land in the Nikom Rotfai Km. 11 area, which will see a mixed use project comprising office buildings and a new conference and international exhibition centre, Thailand’s largest such facility, as well as the Treasury Department’s commercial land development project in the Mo Chit Skytrain station area. The latter is in the process of contract re-negotiations with the concessionaire, with plans to further develop the area. And the area of 30 rai opposite to Dan Neramitr is to be developed by Grand Canal Land Public Company Limited and BTS Group Holdings Public Company Limited. All such endeavours result in the great potential for the residential real estate market. Coupled with a market with a small supply as well as limited available land for development, there is an opportunity for investors to buy units in the area for investment and for residential purposes. The pricing trend is likely to continue to increase in the future.